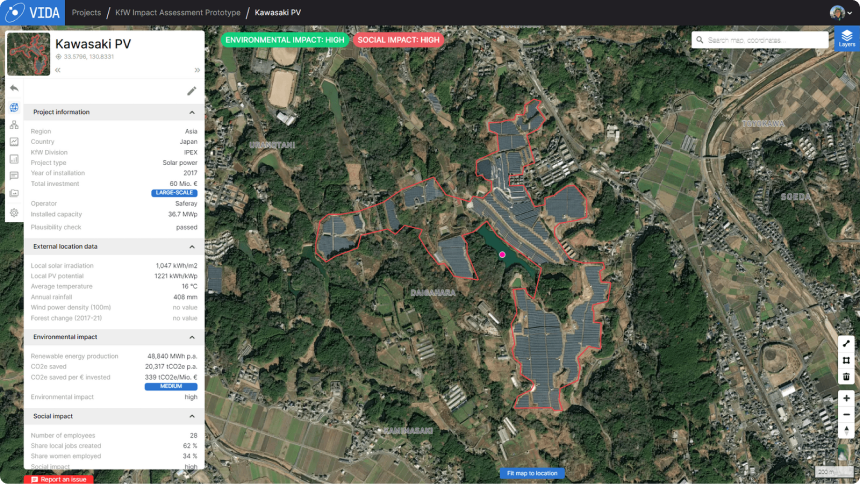

Analyzing impact and climate risk of infrastructure investments for a bank

A German bank uses VIDA to monitor and manage the impact of its assets from Jamaica to Japan. Sustainable finance is the fastest-growing market in the financial sector. Ever more banks and funds commit to a specific impact of their investments in the world.

| Product | Impact management |

| Country | Japan, Jamaica |

| Year | 2022 |

But even category leaders, such as our user, do not know enough about their own global portfolio to reliably report and improve their impact (emissions reduction, biodiversity, employment and others) in real-time.

How do you know what is happening where across your portfolio? How do you track changes and improvements globally while investing from Germany?

That was the challenge for our user. To meet it, VIDA was implemented as the operating system for impact management.

By using VIDAs map-based and customizable approach, our user is able to monitor global portfolios and assets in real-time by bringing together a multitude of internal and external data sets. By then collaborating in VIDA across the organization the data is further improved. Missing data is requested, data is visually validated, and questions and open points are addressed by the user’s team.

The initial portfolio used sites from Asia, Africa, America, and Europe. Now the user can add notes, pictures, sensor data (e.g. smart meter data), and more to make the assessment more granular. Project consultants can access the data and in turn feed their data back into the VIDA platform. And based on the initial portfolio, the user can easily add additional sites and expand the impact metrics according to the user’s own impact management plan and models.

We are proud to be part of a global impact investment movement and help investors to know what’s happening where.

More stories

Ready tomanage your climate risk?